When someone you love is experiencing cognitive decline, each day can feel overwhelming. Once your family has decided what level of care is necessary, however, preparing for the legal and financial side of dementia care can help reduce the stress.

As elder law attorney Greg Piede, Esq. puts it, “Ensuring your family member is in a place where they’re happy and family can visit is the most important goal. Number two is protecting assets.”

In this article, we’ll explore the documents and services that can help you and your family plan for memory care.

Legal support for families facing dementia

As the disease progresses, individuals with dementia may not be able to make informed decisions on their own. Knowing who will be responsible for health care, finances and living accommodations can give everyone peace of mind.

To have confidence that your family member is receiving the care they would choose for themselves, it’s important to make a few decisions early on.

Power of attorney (POA)

A power of attorney grants an individual the authority to make financial or legal decisions on behalf of someone else. This ensures that if an older adult becomes unable to manage their affairs, a trusted person can step in seamlessly.

To caution against waiting, Piede notes that setting up a power of attorney is simple and inexpensive, and it gives family the ability to make decisions. On the other hand, Piede says, “If you don’t specify who you want to help make decisions for you and you lose the ability to make decisions for yourself, a judge will make that decision for you.”

This is called a guardianship, and Piede suggests avoiding it because it’s expensive, makes assets vulnerable and can come with interpersonal complications. “It’s at least as bad as divorce court,” he says.

But just because someone is experiencing cognitive decline doesn’t mean they can’t establish a POA.

“The standard of capacity is that you need to know what you're doing while you sign the document,” Piede says.

Families can help ease the process by signing during a good time of day and in a comfortable, familiar environment with family photos around.

Another way to make the process easier is to unify the whole family in the decision. This may require having challenging conversations about care, but it’s worth it. If different family members have the POA changed multiple times, you’re likely to end up with a guardianship.

So, what should you consider when choosing a POA? Piede notes that the role takes work, so it’s important to find someone who’s up for the job. His three criteria are to choose someone who:

- Cares enough to do the work a POA requires

- You trust

- Is financially savvy

While the first two are critical, Piede says this last point is a bonus. “I’ve got a lot of people who aren’t good with money, and they’re doing just fine as people’s powers of attorney.”

Healthcare proxies

Healthcare proxies are appointed individuals who can make healthcare decisions if an individual cannot communicate their wishes themselves.

When establishing a healthcare proxy, Piede says the most important consideration is choosing someone who knows what your family member would want medically. That might include tough decisions about what to do in the event of an accident or resuscitation, or if an aggressive surgery should be attempted. Relatedly, Piede notes that you want somebody with the emotional strength to follow through on those wishes.

The final consideration – which doesn’t apply to POA – is location. “If something happens and somebody needs to run to a hospital, you want to know they can get there quickly,” Piede says.

While the process can feel daunting, elder care attorneys like Piede – who specialize in meeting the legal needs of older adults – can help. An experienced attorney can assist in navigating the complexities of establishing long-term care.

Financing memory care

Whether your family decides to provide care at home or explore residential memory care options, “How do I pay for memory care?” is an inevitable question. There are many ways to cover the cost of memory care, ranging from savings accounts and long-term care insurance to liquidating assets, such as a home.

Long-term care insurance is designed to cover services that regular health insurance does not, including memory care. However, policies vary, so it’s crucial to review the terms and understand what’s covered. Some policies may focus on in-home care, while others emphasize residential care. Anticipating what kind of care your family member needs now – and may need in the future – can help guide your decision.

In addition to long-term care insurance, there are several benefits that can help pay for care:

- Medicare may provide limited assistance with medical necessities, but it won’t cover room and board for long-term care, including memory care communities.

- Veteran benefits can be very helpful in covering memory care for veterans and/or their spouses. The approval process is often very slow, but once approved, the VA will reimburse for past expenses.

- Social Security Disability Insurance (SSDI) may provide support for those living with Alzheimer’s or dementia prior to reaching retirement age.

Community and professional memory care resources

Legal and financial planning can help reduce stress, but building a supportive community around the person you love – and yourself – provides emotional relief and practical assistance. In addition to family and friends, consider utilizing local resources. Here are a few ideas for how to get started:

- Connect with local and online Alzheimer’s and dementia services.

- Join caregiver support groups to develop relationships with others who understand what you’re going through.

- Reach out to memory care communities in your area to learn more about their prices, services and amenities.

Tapping into available resources benefits both those directly affected by dementia and those providing care.

Supporting the whole family

Creating a comprehensive plan that safeguards both personal and financial well-being empowers families to focus on what truly matters – providing compassionate support and quality time for those they love.

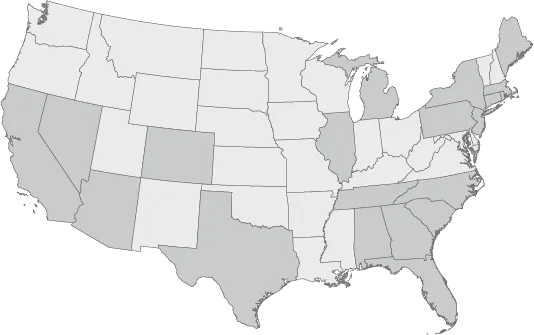

Though challenging, it’s important to remember that you’re not alone on this journey. At Atria, our memory care neighborhoods are designed to provide comfort, security, connection and peace of mind. Contact a community near you to learn more about our research-based, personalized approach to improving quality of life for those experiencing Alzheimer’s or other forms of dementia.

You might also like

Want to learn more about life at Atria Senior Living?